How to Create Your Own Crypto Currency on the Ethereum Base

- Aug 31, 2018

Types of cryptocurrency and their main distinctions

Nowadays, cryptocurrencies have become a global phenomenon known to the most people. The Blockchain technology has opened up a new era in finance. Three main types of cryptocurrency are: bitcoin, altcoins, and tokens.

The blockchain brings together the three main types of cryptocurrency. Bitcoin was the first blockchain. After Bitcoin, many new blockchains were created — these are called altcoins. NEO, Litecoin and Cardano are solid examples of altcoins. Finally, tokens/dApps — the third main type of cryptocurrencies.

Bitcoin

It is a digital currency that you can send to other people. This may be as a gift, for services or for a product. You get the idea — it’s just like the money we use in our bank accounts (USD, EUR etc.). But it’s digital; it isn’t physical. However, that isn’t all that makes it different. It’s also decentralized, meaning it doesn’t rely on a bank or third party to handle it. With Bitcoin, each transaction happens directly between users — it’s called a peer-to-peer network. This is all possible thanks to the blockchain. Bitcoin introduced blockchain technology to allow users to send and receive Bitcoin.

Altcoins

The majority of altcoins are just alternate versions of Bitcoin with minor changes. That’s how they got the name ‘altcoins’. It’s important to understand, though, that not all altcoins are just alternate versions of Bitcoin. There are some that are very, very different to Bitcoin and have very different goals/purposes. Some altcoins use different algorithms to Bitcoin. For example, Factom is an altcoin that uses PoS (Proof of Stake). In PoS, there are no miners. Instead, there are stakers. Stakers are people that verify transactions for rewards, just like miners. But instead of racing to verify a block before anyone else does, they are selected one by one to take their turn. This uses much less electricity because their aren’t thousands of miners using their electricity to try and verify the same block. Instead, there is just one ‘staker’ per block.

As we can see, not all altcoins are super similar to bitcoin. In fact, Ethereum and NEO are examples of altcoins that are rather different to Bitcoin. You know that Bitcoin is used as a digital currency, right? Well, Ethereum and NEO were not designed to be used as a digital currency. Instead, they were designed as huge platforms for building apps on a blockchain.

On Ethereum and NEO, you can actually build your own applications. This is the most common way that new cryptocurrencies are created; they are made on blockchains that allow app building, like Ethereum and NEO. Ethereum’s technology is called a smart contract. A smart contract can automatically execute transactions when certain things happen.

These ‘things’ (also called conditions) are written into the smart contract when it is created.

Because of smart contracts, no third party is needed. Bitcoin means there is no third party needed in direct payments, but smart contracts mean there is no third party needed in lots of things — like the sale of a house, the sale of electricity or the sale of a stock on the stock market.

Of course, you can’t actually put electricity into a smart contract, can you? So, instead, you put a token into the smart contract that legally represents the electricity. This is one of the best things about smart contracts on Ethereum and NEO etc. — you can tokenize real things and put them on the blockchain.

Tokens (for dApps)

The third main type of cryptocurrency is a token — the same kind we’ve just been talking about! Out of the three main types of cryptocurrency, these are the ones I find most interesting. Compared to the other two main types of cryptocurrency, they are completely unique in the fact that they do not have their own blockchain.

They are used on dApps (decentralized applications); these are the apps I told you about that can be built on blockchains like Ethereum and NEO. The dApps are built to use smart contracts, which is why they use tokens.

Their tokens don’t have to represent a physical thing like electricity or a house, though. They can instead be used to purchase things on the dApp. Either that or they can be used to get certain advantages — things like discounted fees and voting fees.

Tokens always have a price that they can be sold for, which is why some people buy them. Some people buy tokens to sell them later for a higher price, instead of buying them to use them on the dApp.

Because dApps are built on other blockchains (like Ethereum and NEO), a token transaction is still verified by the nodes on the Ethereum or NEO blockchain. This means the transaction fee is still paid with Ether or NEO, and not with the token.

So, to make a transaction on a dApp (i.e. to use a token), you must have some Ether or NEO (or whichever altcoin the dApp is built on) to pay for the transaction fees.

Why cryptocurrency has been producing and what goals it fulfills

For the same reason like simple money is needed. It’s universal goods that is a unit of value while selling or buying other goods. Cryptocurrency has some major advantages.

For the first, it’s it is not in danger of inflation: their number is limited and known in advance. One more benefit is decentralized structure. There is no unified center and it’s extremely hard to break efficiency of this system. Simply, the network doesn’t have the unified owner, it’s controlled by users worldwide.

Secondly, the great advantage is anonymous. It is easy to trace transactions and see how many bitcoins were transferred from one wallet to another. But to identify the wallet owner is rather hard.

For now, cryptocurrency acts as the equivalent of company’s stock market. Anyone can create a token as the equivalent to any goods or operations. But the most important thing-there is no any difficulties or issues on the legal level.

Smart contacts aim to replace traditional contracts by reducing the transaction cost and providing a more secure and trustworthy approach to arrangements performance.

These contracts should be:

decentralized,

publicly available,

execution result should be trusted by all contract participants.

Contracts can be encoded on any blockchain, but Ethereum is mostly used since it gives unlimited processing capability.

Types of emissions

The type of emission of each token can aid one in analyzing the token and one must resist the trap of attempting to apply a universal criterion. There are base implications of these systems that must be considered when examining each protocol in the short-term and long-term.

- Finite supply with no emission

The first cryptocurrency is NEM. This system has finite supply with all tokens outstanding upon network inception. This implies that all of the inflation will be seen in the price rather than the supply as it is fixed as a property of the system. If this network is to gain value into the future and able to facilitate more and capture a larger chunk of markets like remittance, there is an added advantage in buying large amounts of tokens in the early stages of development.

- Finite supply with controlled emission

The next digital asset we will examine is Bitcoin. Bitcoin has a finite supply and a controlled emission, which has certain advantages and disadvantages. There is the possibility of the over-valuation of Bitcoin during its early stages when inflation is high but as seen in the graph, there is an exponential decrease in the rates of inflation as time goes on. An added advantage of this supply structure is the ability to project the price using the utility of the network at any point in time.

- Infinite supply with uncontrolled emission

The final digital asset we will consider is Ethereum. Ethereum has a variable rate of emission and no supply cap. In 2017, Ethereum was projected to have an inflation rate of 14.75%. This rate of inflation is projected to decline to 1.59% by 2065 but this still leaves the situation quite open ended. That being said, there are new implementations that may reduce the rate significantly. The general consensus on the supply cap of the network based on the protocol's properties is 100 million tokens.

In conclusion, there is no superiority between the supply structures as they all have different implications, but they all must be analyzed through their specific lens when trying to get an in depth picture of the long-term for each token.

Cryptocurrency exchange

There are two types of cryptocurrency exchanges: the first type is called a “fiat exchange”. Fiat exchanges allow you to buy cryptocurrency with fiat money (dollars, euros, pounds, etc.).

The second type of exchange is called a “pure cryptocurrency exchange” or “altcoin exchange”. These exchanges don’t deal with traditional payment methods like credit cards and banks.

So, to explain the difference and why you need both, let’s look at a coin called Ripple. (XRP)Ripple is currently the third largest cryptocurrency by market cap. Most Americans use a platform called Coinbase to buy cryptocurrency, but Coinbase doesn’t sell Ripple.

So how do you get Ripple then? You must first use Coinbase–your fiat exchange–to buy bitcoin with your bank or credit card. Once you’ve purchased bitcoin, you need to send to a pure cryptocurrency exchange, like Binance.

Best Fiat Cryptocurrency Exchanges

Coinbase is a good gateway into cryptocurrency, especially if it is your first time buying. Since most cryptocurrencies must be purchased with bitcoin or ether, Coinbase is a good entry point whether you want Bitcoin or any other cryptocurrency.

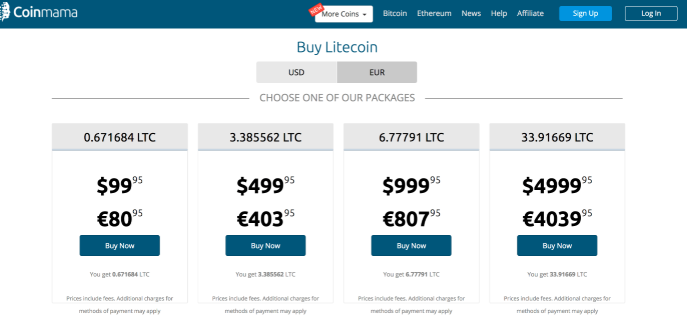

Coinmama is a cryptocurrency broker that sells bitcoin, litecoin and ether for credit card. The fees are somewhat high so it may not be the best long term solution, but is a good and fast way to get started.

Bitpanda is one of Europe’s largest cryptocurrency exchanges. It sells bitcoin, litecoin, ether, ripple, bcash and a number of other coins. Bitpanda has some of the lowest fees among European Bitcoin brokers at around 3% per credit card buy, and about 1% for bank transfer.

Kraken is one of the world’s largest cryptocurrency exchanges. It has been around for a long time and appears to be one of the most well run exchanges. Kraken is harder for beginners compared to the exchanges listed above, since it requires you to understand orderbooks and order types. However, if you plan on buying larger quantities of coins then Kraken will be a good option since the fees are lower than some of the options listed above.

Pure Cryptocurrency Exchange

Binance is a cryptocurrency exchange based in Malta. It has very low fees at just 0.05% per trade. It has the most volume of all cryptocurrency exchanges. This means it’s very easy to go in and out of coins at a good price. Most coins have deep markets, making Binance ideal for both big and small buyers and traders.

Binance is a cryptocurrency exchange based in Malta. It has very low fees at just 0.05% per trade. It has the most volume of all cryptocurrency exchanges. This means it’s very easy to go in and out of coins at a good price. Most coins have deep markets, making Binance ideal for both big and small buyers and traders.

Changelly is a unique exchange in that you don’t actually need to deposit coins. You simply tell Changelly which coin you want to buy, and how much of it you want to buy. Changelly will then tell you how much of the coin you are buying with to send.

Bittrex is one of the world’s largest 10 cryptocurrency exchanges. It supports a bunch of coins that other exchanges support. It generally has good volume across all its pairs, making it ideal for both large and small buyers and sellers.

Bittrex is one of the world’s largest 10 cryptocurrency exchanges. It supports a bunch of coins that other exchanges support. It generally has good volume across all its pairs, making it ideal for both large and small buyers and sellers.

Poloniex used to be the largest cryptocurrency exchange, but lost a lot of users when it had trouble scaling to support a surge of new signups. Recently, however, Poloniex was acquired by Circle. Circle is partly backed by Goldman Sachs, one of the largest investment banks in the United States.

Cryptopia is a cryptocurrency exchange based in New Zealand. It is much smaller than the exchanges listed above, but is targeted at a different type of user. Cryptopia has a lot of small and obscure coins listed on its exchange. Most of the coins on Cryptopia are only listed on Cryptopia and aren’t listed on the largest exchanges like Binance or Bittrex.

How crypto currency can be guaranteed

So, the Blockchain is decentralized and publicly available. But can we trust the results stored in it? At first glance – looks like no, but it is just a problem to solve. And of course, the solution is found. In the first and most popular application based on a blockchain, Bitcoin, there was used an approach known as Proof of Work (PoW) – to save the blockchain from replacement of long part of a chain with blocks of other data (as we know, it is the only way to edit the data in a blockchain).

In Bitcoin the implementation of PoW uses the calculation of Merkle tree hash with an additional restriction for the result. The source of this hash is the content of the new block and the hash of the previous known block. But the calculation of the hash is not a very complex task itself and to make it complex PoW requires that the result should be less than some number value defined by the protocol. The value of the number is calculated based on the estimation of the total capacity of the network, so that in average only one new block should be added to the blockchain per 10 minutes regardless of the total network capacity.

Ethereum uses a similar implementation of PoW but with some modifications to make calculation more difficult for the hardware designed especially for hash calculation, making the network more protected from the concentration of the biggest capacity in one node, because if one node (or a set of joined nodes) controls > 50% of the total capacity, it can recalculate a long chain of blocks to rewrite the data.

What else to consider before launching a cryptocurrency

Exactly know what you want to achieve

Creating a proper business plan for your cryptocurrency startup and knowing what you want to achieve with it comes firstly. You need to make sure that implementing this type of idea will be worth it. Having a positive attitude and analyzing the competition is very helpful in this regard. Basically, the focus has to be on investing the right amount of money into your ideas and making sure that you have a huge demand for your products or services.

Blockchain, by providing access to both operational and financial information in real time, will give you and your suppliers updated information in real time, including data about your shipments.

Where to Obtain Real Help

Red-chain https://red-chain.com is a blockchain-based platform to help you organize your business relationships between manufactures and service providers to consumers in the smart and secure way. Red-chain is based on a blockchain technology with decentralized nodes.

How it works:

1. You open an attorney built Contract at Red-chain - Red-chain helps you to choose a Contract based on your operation details.

2. Choose all important conditions of your deal - We invite all your participants to choose and reconcile all the performance of the contract.

3. Specify all the factors important for the performance of the contract - We build a “CRM-road-map” of the Contract.

4. Name all the participants who are involved in the business operation – Red-chain controls and notify the parties of the execution of a contract.

How to Create Your Own Crypto Currency on the Ethereum Base:

Create token contract address in the Ethereum network. Tokens distribution will take place from this address.

Choose a name of the token, as example - Best Coin.

Choose a symbol, for example – BEC.

Choose a number of coins, it’s invariably, for example 10 000.

Choose if tokens divide, if yes- how many marks after a comma will be maximum.

Deploying Your Token

Now all these data should be inputted into a smart contract.

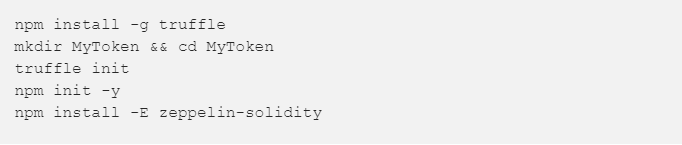

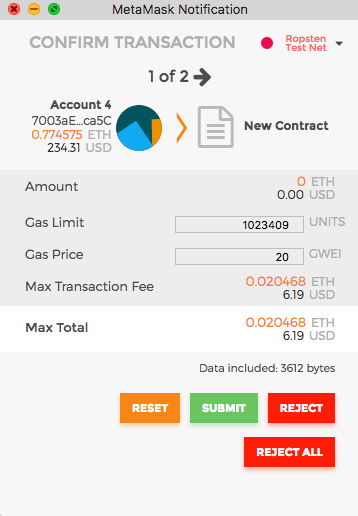

If you don’t have node.js, install it now (The tests in below will not work with versions earlier than node.js 8). Then open a terminal window and do:

Open NewToken.sol, insert needed values instead of variables in < >:

totalSupply – total amount of tokens

name – full token name

decimal – a number of marks after a comma. In smart contracts everything is stored only in whole numbers. That’s why you should indicate the number of marks, if you want to have a possibility to enroll not a whole number if tokens

symbol – symbol for markets

You’ll get something like this:

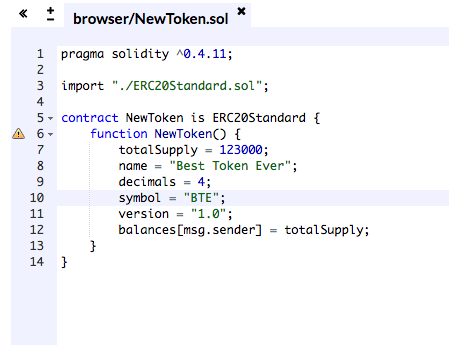

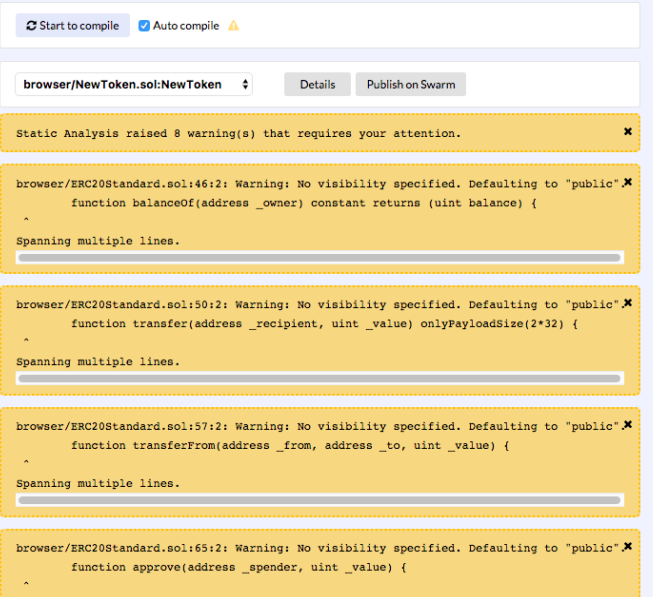

Save and deploy a contract into the network. For testing deploy into Ropsten test net. For deploying a client is needed. Use MetaMask – it can’t compile smart-contracts on Solidity, that’s why make compilation.

In remix editor open compile tab. When choose your own contract in select tab and clock on Details you can see bite-code and other information.

For deploy click on Run, choose Injected Web3, choose Account. Insert any information needed in fields (gas, value), click Create.

Click Submit. Your contract has been deployed (after input into blockchain). Deploy is confirmed in MetaMask'е with a sign "Contract published".

Making Operations with Our Token

For operations with token two wallets are needed- someone who already has it by default (contract founder, ERC20 standard) and someone who needs to have it.

To make operations with our token (transfer if, for instance) we can on contract page on etherscan, or on remix page.

For token transfer, insert recipient address and number. After this, and data inserting into a blockchain, you can check your balance and the balance of someone who got tokens, by operation balanceOf.

Best of luck to you in your blockchain adventures!